Market performance this year has been a “headscratcher.” In the face of macroeconomic resistance, the market has prevailed – for now. The three major indexes are in positive territory year-to-date. The Dow has remained relatively flat, but the S&P 500 and Nasdaq are firmly situated in the green. The Dow is up 1.86% YTD, the S&P is up 11.53% YTD, and the Nasdaq is up 26.51% YTD (as of June 7th, 2023).

In stride with the Year in Review piece we released for 2022, the Fed has remained persistent in its battle against inflation. 10 rate hikes since March of 2022 (3 in 2023) situates the federal funds rate at 5%, and there is speculation in the marketplace this isn’t the peak. We shall see. We know inflation has come down from its highs in mid-2022, but it seems there is significant resistance at the levels we have fallen to – levels much higher than the Fed’s 2% target. So, where do we stand?

Into the data…

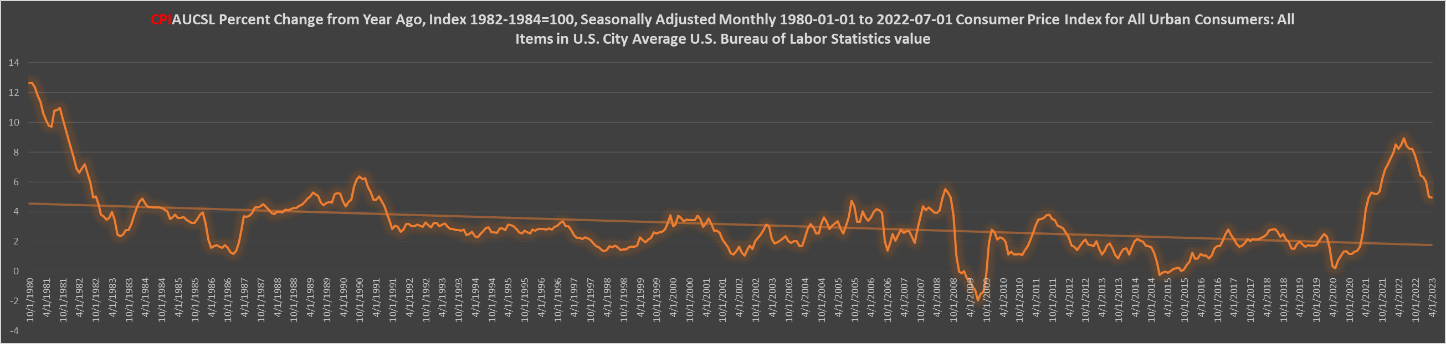

The Consumer Price Index data for April shows an increase of 4.95% year-over-year. Remember, this is the same as saying the basket of goods and services you purchased in April of last year is 4.95% more expensive. March CPI data showed a 4.98% increase year-over-year. Uh oh. 4.98% to 4.95% from March to April seems a little strange, doesn’t it? If you hear the word “sticky” associated with inflation, this minimal change is being referenced.

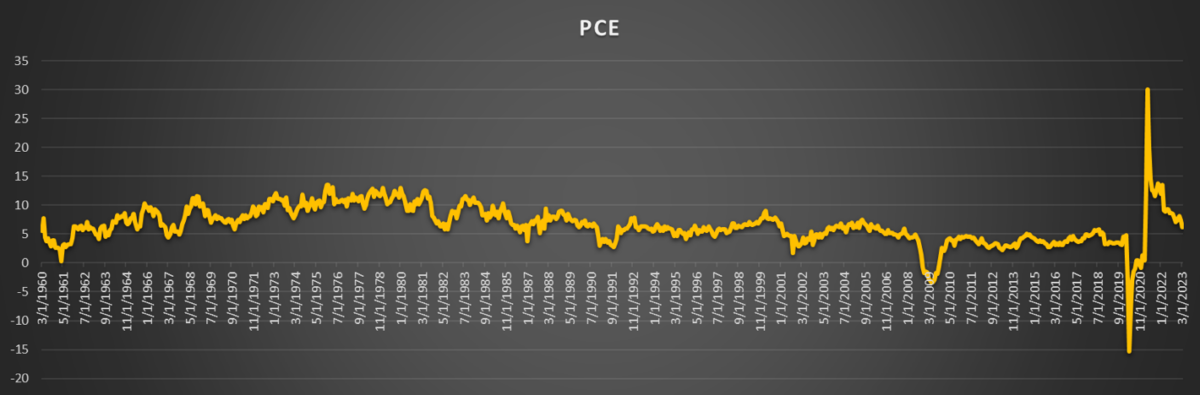

Personal Consumption Expenditures remain elevated from the levels experienced from 2010-2019. PCE averaged 3.82% during these years. Today the index is at 6.15%. This means that, ceteris paribus – all other things equal, consumers are spending 2.33% more than they did during the previous decade. 2020-2022 were excluded intentionally because of Covid, government stimulus payments, and an overwhelming change in lifestyle for most individuals and families.

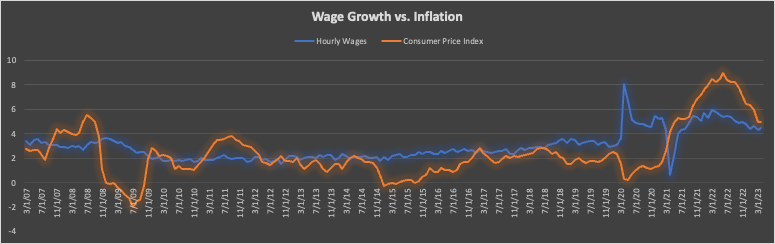

Hourly earnings for employees in April are up 4.44% year-over-year. If inflation were at the Fed’s 2% target, this would be a good thing, but it isn’t. 4.95% – 4.44% = -.51%. Earnings aren’t keeping pace with inflation. Again, earnings should outpace inflation, not just keep up! The equation above is how real earnings are calculated. When real earnings are negative, the consumer tends to feel it. Where is the proof? Well, let’s continue to look at the numbers.

We have seen an inversion of the personal savings rate and revolving credit. Typically, when consumers burn through savings, they begin to lean on credit. See the chart below for a visual.

The inversion began in 2021 and is significant because we haven’t seen revolving credit higher than the personal savings rate since…2008. This is not the same environment as 2008, but it is worth mentioning. It is also worth mentioning total consumer credit is at an all-time high. No wonder savings are low.

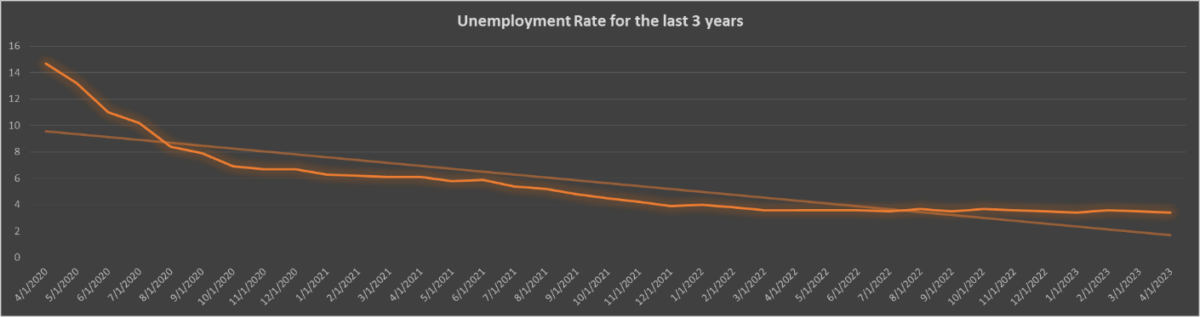

Another metric worth noting is the unemployment rate. Since January of 2022, the unemployment rate has averaged 3.6%. In February, March and April of 2023, the unemployment rate was 3.6%, 3.5%, and 3.4%, respectively. A low unemployment rate makes the Fed’s job more difficult. When people have jobs, they earn money. When people earn money, they spend money. When people spend money, prices tend to increase. As simple as it sounds, that’s how it works.

To complicate matters more, we are navigating a debt ceiling dilemma. Not raising the debt ceiling would be catastrophic economically. Defaulting on our debt obligations isn’t the only result of keeping the ceiling where it is – millions of Americans would lose their jobs, the housing market would likely crash, and the stability of the global economy would likely unhinge. Deep recession would be inevitable. Does this have your attention? It should. It seems there is only one option – raise the debt ceiling. That’s exactly what happened. But what are the consequences of raising the debt ceiling? Well, for starters, the government will print more money. Printing money is inflationary – the very thing our Fed is working so hard to combat. By printing more money, the Fed may have to continue to raise interest rates, further straining the banking industry. Also under watch are bank deposits, which continue to flood out of banks…for three quarters in a row. Banks use deposits to maintain daily functionality. Deposits are the lifeblood of a bank – without them, they cannot operate. Interest rate increases make deposits at banks less attractive.

The alternate route the Fed can try is halting their interest rate hikes and taking the “wait and see” approach. The risk they run taking this approach is inflation spiking again, thus harming the consumer – who, by the way, is beginning to struggle. An already struggling consumer that gets hit might not have the energy to get back up – or it might take a while. Can you think of a synonym for this?

Although macroeconomic indicators paint a grim story, the market has persevered. Actually, that isn’t entirely true. Parts of the market have persevered. Others have struggled. Below is a closer look at sector performance through May 30th, 2023. There is a sector floating market performance. That’s right, technology.

05-30-2023

Communication Services: 32.25%

Consumer Discretionary: 19.25%

Consumer Staples: -2.90%

Energy: -11.23%

Financials: -6.48%

Health Care: -7.05%

Industrials: -0.35%

Information Technology: 34.81%

Communications Equipment: 9.71%

Electronic Equipment, Instruments & Components: -0.01%

IT Services: 11.26%

Semiconductors & Semiconductor Equipment: 60.60%

Software: 35.32%

Technology Hardware, Storage & Peripherals: 35.52%

Materials: -2.69%

Real Estate: -3.48%

Utilities: -9.38%

What does all of this mean? Continued volatility and bumps in the road.

Apart from markets being some of the most complex, multi-variable, unpredictable systems known, it means there will likely be more volatility. Remember, volatility can be good and bad. Either way, navigating volatility requires proper planning. Investment management and risk management are parts of a proper plan. Having someone who understands the markets and their delicate relationships with outside variables is a great starting point for dealing with volatility. We are here to answer your questions, listen to your concerns, and welcome your thoughts. We are here to navigate alongside you.

Call or email us with questions, or, if it suits you, visit us in the office. We look forward to hearing from you.

Author: Spell Carr, Associate Wealth Advisor