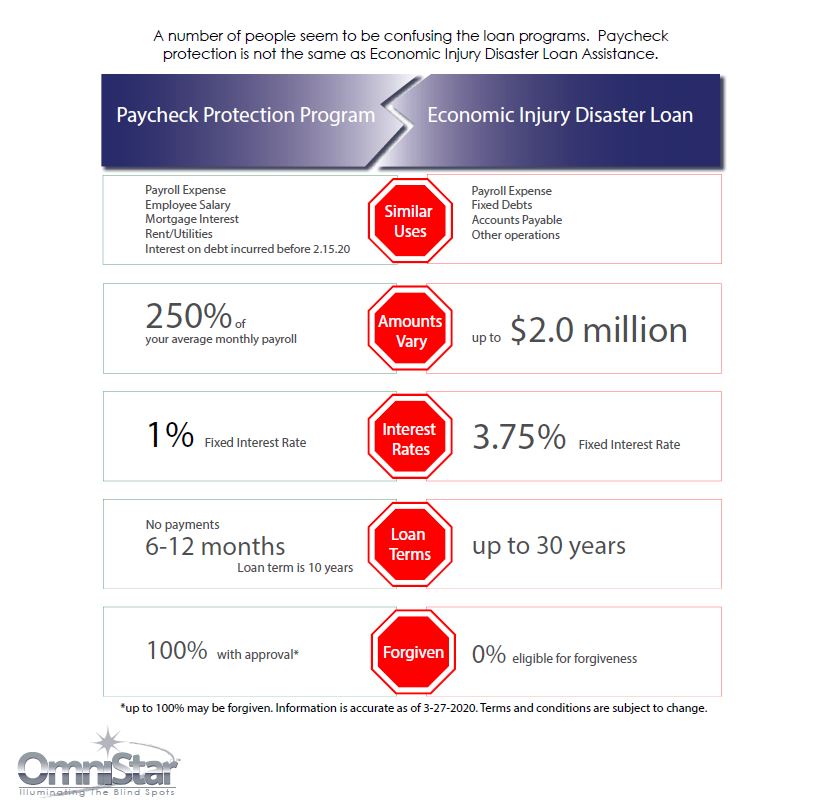

The discussion among many small business owners is how to utilize the Paycheck Protection and Economic Injury Disaster Loans, as well as other programs made available by the Small Business Administration (SBA). We’ve highlighted two options the SBA is offering and what each entails.

Option One

The Coronavirus Preparedness and Response Supplemental Appropriations Act enacted on March 6 expanded the U.S. Small Business Administration (SBA) Economic Injury Disaster Loan Assistance (EIDL) program to provide SBA loans to qualified small businesses. Qualifying businesses can receive up to $2 million in loans to be used for working capital and ordinary expenditures. The actual amount available to any business is tied to its economic injury from COVID-19. Interest rates are 3.75% for small businesses and 2.75% for not-for-profit organizations. EIDL loans are not forgivable. An eligible small business is determined by the number of employees and average annual sales, with different standards per industry. Most manufacturing companies with 500 or fewer employees can qualify. Most non-manufacturing businesses with average annual receipts under $7.5 million can also qualify. There are exceptions by industry.

Loans under this program are available to borrowers that can show they are unable to meet their existing financial obligations as a result of the COVID-19 crisis. For example, Cannabis businesses, casinos, racetracks, charitable organizations and religious institutions are among the businesses that are not eligible.

EIDLs are applied for directly with the SBA and funded by the SBA.

Option Two

The Paycheck Protection Program created through the Coronavirus Aid, Relief and Economic Security Act (CARES Act) expands SBA support for businesses with loans of up to $10 million. This program is administered by the SBA through its 7(a) lending program. Under which the SBA guarantees loans made by banks to qualifying borrowers. Businesses that have been in existence for at least a year can obtain the lesser of 2.5 times their average monthly payroll for the previous 12 months, plus any amount refinanced from the Economic Injury Disaster Loan (EIDL) assistance OR $10 million.

Entities not in existence for the previous 12 months can use their average monthly payroll for the period from January 1, 2020, through February 29, 2020. Funds can be used to cover payroll costs or employee benefits, operating costs and interest on debt obligations. Funds cannot be used to compensate individual employees at an annual rate above $100,000, or to pay for emergency sick or family leave under the second coronavirus response package (Public Law 116-127).

Loans shall bear interest at a rate not to exceed 1%. For loans issued through August 08, 2020, payments of both principal and interest will be deferred for a minimum of six months, although interest will accrue over this period.

Provided a company retains existing employees at or near current salary levels, the debt will be forgiven to the extent that proceeds are used in an eight-week period following loan origination for the following:

-

- Payroll costs and interest payments made on any mortgage incurred prior to February 15, 2020;

- Payment of any lease in force prior to February 15, 2020; and

- Payment on any utility for service before February 15, 2020.

The amount forgiven will be reduced by a formula that takes into consideration any reduction of workforce or wages. Certain documentation is required to be retained, provided as proof and certified to include with an application for loan forgiveness as detailed in Section 1106(e).

Eligible recipients must meet one of the following requirements:

-

- 500 employees or fewer, or;

- Meet applicable employee size standards for their North American Industry Classification System (NAICS), or;

- 500 employees or fewer BY LOCATION for those in the Accommodation and Food Service industry as defined by their NAICS code or for any business acting as a franchise that is assigned a franchise identifier code by the Small Business Administration. Also eligible are sole proprietors, independent contractors and other self-employed individuals, including so-called gig economy workers. Cannabis businesses, casinos, racetracks, charitable organizations and religious institutions are among the businesses that are not eligible.

The SBA website offers a size standards tool to assist in determining whether a business is small.

Loans under the Paycheck Protection Program are third-party loans with SBA guarantees. Applications are made directly through a participating lending institution. Such institutions can be found at www.sba.gov. The site includes lists of participating institutions, as well as a Lender Match tool, which asks for basic information to share with participating lenders in an effort to match applicants with interested lenders.

Borrowers are precluded from receiving SBA funding under the Paycheck Protection Program and an Economic Injury Disaster Loan (EIDL) for the same purpose.